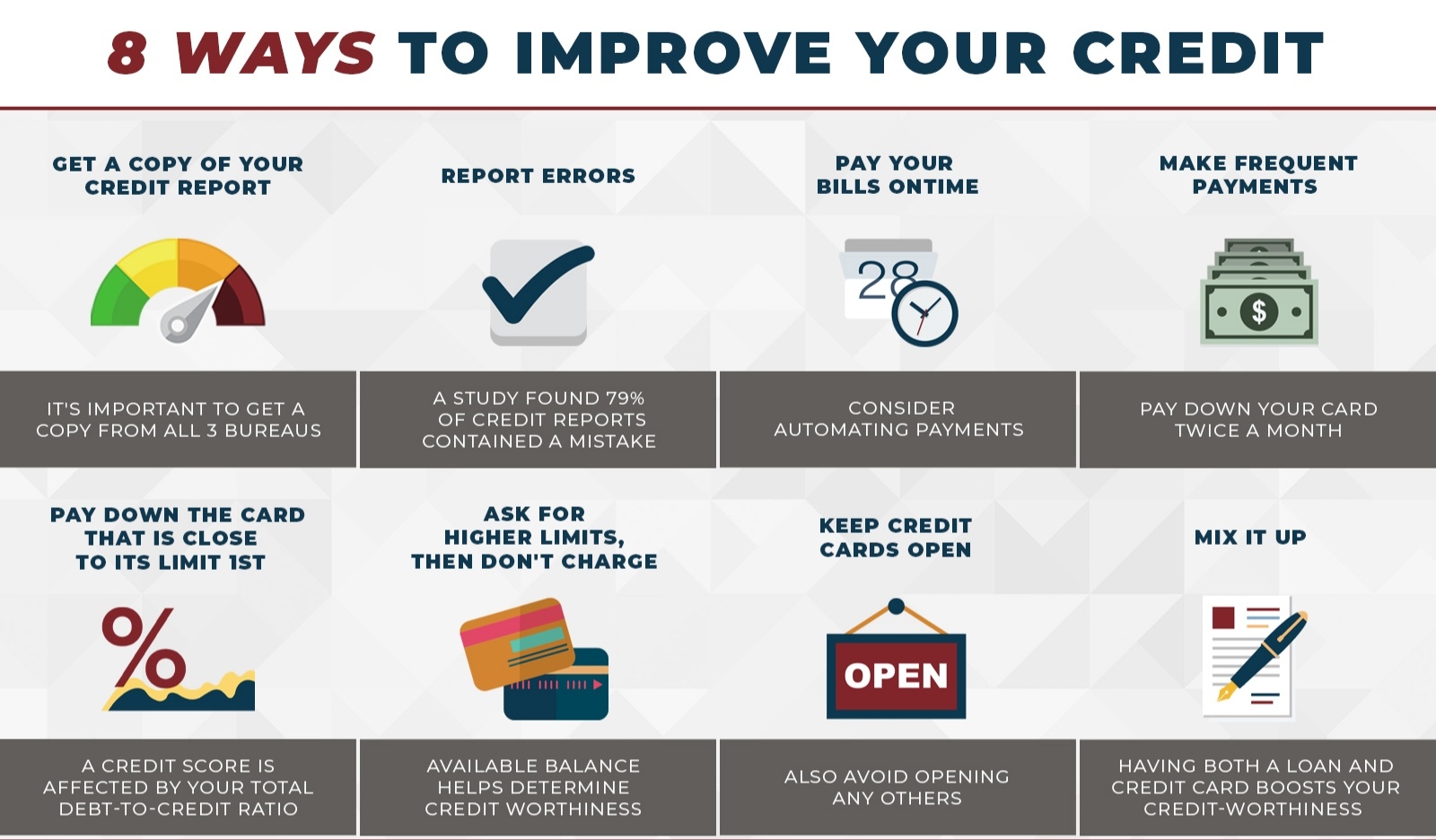

Improving your credit score to secure a bond typically requires consistent effort over time. Here are key steps to boost your credit score:

1. Pay Bills on Time

Payment history is the most significant factor in credit scoring. Late payments can significantly lower your score.

Set up automatic payments or reminders to ensure all bills (credit cards, loans, utilities, etc.) are paid on or before their due dates.

2. Reduce Credit Utilization

Keep your credit card balances low relative to your credit limits.

Aim to use less than 30% of your available credit limit; under 10% is even better.

If possible, pay off credit card balances in full each month.

3. Avoid Opening or Closing Too Many Accounts

New credit inquiries can temporarily lower your score. Apply for credit only when necessary.

Closing accounts can reduce your available credit and negatively impact your credit utilization ratio.

4. Check Your Credit Report for Errors

Obtain your credit report from credit bureaus and check for inaccuracies.

Dispute any incorrect information, such as accounts you don’t recognize or errors in reported payments.

5. Diversify Your Credit Mix

Having a mix of credit types (e.g., credit cards, installment loans, mortgages) can boost your score, but don’t open new accounts just for this reason.

6. Build a Credit History

If you’re new to credit, consider using a secured credit card or becoming an authorized user on someone else’s account to establish a history.

7. Keep Old Accounts Open

The length of your credit history contributes to your score. If you have old accounts in good standing, keep them open.

8. Pay Off Debt Strategically

Focus on paying down high-interest debt first.

Consider the debt snowball (smallest balance first) or debt avalanche (highest interest rate first) method.

9. Limit Hard Inquiries

Each hard inquiry (e.g., when applying for loans or credit) can slightly lower your score. Plan applications wisely.

10. Work with a Professional if Needed

If your score is very low, consult a credit counselor or financial advisor to create a tailored plan.

Improving your credit score takes time, so start these steps as soon as possible. With a strong credit score, lenders are more likely to approve your bond application with favorable terms.