Lake Properties

Lake Properties Lake Properties There’s a soft, leafy hush that greets you in Newlands — the suburb sits right at the foot of Table Mountain, its streets lined with camphor and plane trees, and on a wet winter morning it feels as if the whole place has been freshly rinsed. Newlands is one of Cape Town’s upmarket Southern Suburbs and, thanks to its winter rains and mountain-fed microclimate, it’s often described as one of the wettest suburbs in South Africa.

Morning — coffee, camphor trees, and a slow start

Your day usually begins slowly here. Locals love a relaxed breakfast under the old camphor trees at spots like The Gardener’s Cottage (Montebello), where brunch is as much about the garden setting as the food. It’s the kind of place where neighbours run into one another, dogs nap in the shade, and someone always has a gardening tip to share.

If you’re the outdoorsy type, a short walk after coffee takes you into Newlands Forest — a patchwork of pine and indigenous trees, little streams and popular trails that link up toward Kirstenbosch. Hikers and families use these paths for a quick morning leg-stretcher or a longer scramble up towards the mountain’s eastern slopes.

Late morning — errands, design, and small shops

By mid-morning people drift into the small local centres — Montebello’s design hub, a few independent boutiques, or head across to neighbouring Claremont for the bigger shops and Cavendish Square mall. The vibe here is residential-first: you’ll find lots of family-run businesses, a couple of cosy bakeries and delis, and plenty of green front gardens. (If you’re house-hunting, you’ll notice many properties have mature gardens — a big plus for families.)

Afternoon — slow lunches and sporty afternoons

Afternoons can be lazy: long lunches, homework with a view of the mountain, or a quick trip into town. The commute into Cape Town’s CBD is straightforward — it’s roughly 9 km and about a 20-minute train or short drive on a good day — so many residents work in the city but come home for the quieter evenings.

If you’re sticking around the neighbourhood, match-day livens things up. Newlands’ sporting heartbeats — the historic Newlands Cricket Ground (and the older rugby stadium precinct) — mean there are days when the suburb fills with the chatter of fans, the smell of braais and the rustle of extra traffic. It’s part of the local character: family-friendly, loud and proud when sport’s on.

Evening — pubs, pizza, and quiet streets

As the sun drops behind Devil’s Peak and Table Mountain, Newlands softens. The Foresters Arms (“Forries”) is a classic local pub — decades old and still a favourite for a casual dinner or to catch a game. Elsewhere you’ll find intimate restaurants and takeaways that suit the low-key, community-oriented nights that many Newlands residents prefer.

Community feel — who lives here and why

Newlands attracts families, professionals, and people who value easy access to nature without sacrificing proximity to the city. Schools in the southern suburbs, leafy streets, and the neighbourhood’s overall quiet make it a strong draw for buyers who want space and a suburban rhythm. On weekends the suburb feels neighborly — people walking dogs, kids on bikes, homeowners tinkering in gardens.

Practicalities — the things you notice after six months

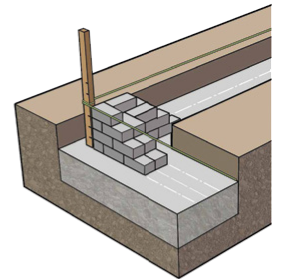

- Weather: the winter rains are real — roofs, gutters and good drainage matter here more than in drier suburbs.

- Match days: sporting fixtures bring crowds and traffic, so proximity to the grounds is great for fans but can complicate parking and noise for some homes.

- Transport: strong train and road links make commuting easy, but like any popular suburb, peak-time traffic can build on the M3/M5 corridors.

Why people stay

People stay in Newlands because it feels like a small town tucked against a mountain: green, safe-feeling, and proud of its local cafés, pubs and sports culture. You can run a 30-minute loop in forested trails in the morning, pick up fresh bread mid-afternoon and still have time to watch a sunset over Table Mountain from your back lawn.

Lake Properties Pro-Tip:

When you’re house-hunting in Newlands, bring a simple checklist: inspect gutters and roof condition (winter rainfall is heavy), ask about sound insulation and parking on match days if the property is near the stadium precinct, and walk the route to the nearest forest access — a home with an easy gate-to-trail stroll is worth a premium for many buyers. Finally, visit on a weekend and a weekday morning to feel both the calm and the match-day energy before you decide.

If you know of anyone who is thinking of selling or buying property, please call me

Russell Heynes

Lake Properties

www.lakeproperties.co.za info@lakeproperties.co.za

083 624 7129