Lake Properties Lake Properties

Lake Properties Lake PropertiesHere's a detailed step-by-step breakdown of what a seller needs to do after accepting an offer on a house in South Africa, including what happens behind the scenes and how long each step might take:

1. Sign the Offer to Purchase (OTP)

- What it is: A formal agreement between buyer and seller detailing the purchase price, conditions (e.g. subject to bond approval), and deadlines.

- Why it's important: Once both parties sign, the OTP becomes legally binding. Backing out can lead to legal consequences.

- Timing: Immediate, usually done with the estate agent present.

2. Appoint a Conveyancing Attorney

- Who appoints them: In South Africa, the seller typically chooses the conveyancer.

- Role: The conveyancer prepares all documents, liaises with the bank (if there's a bond), municipality, SARS, and buyer’s attorney. They also ensure registration at the Deeds Office.

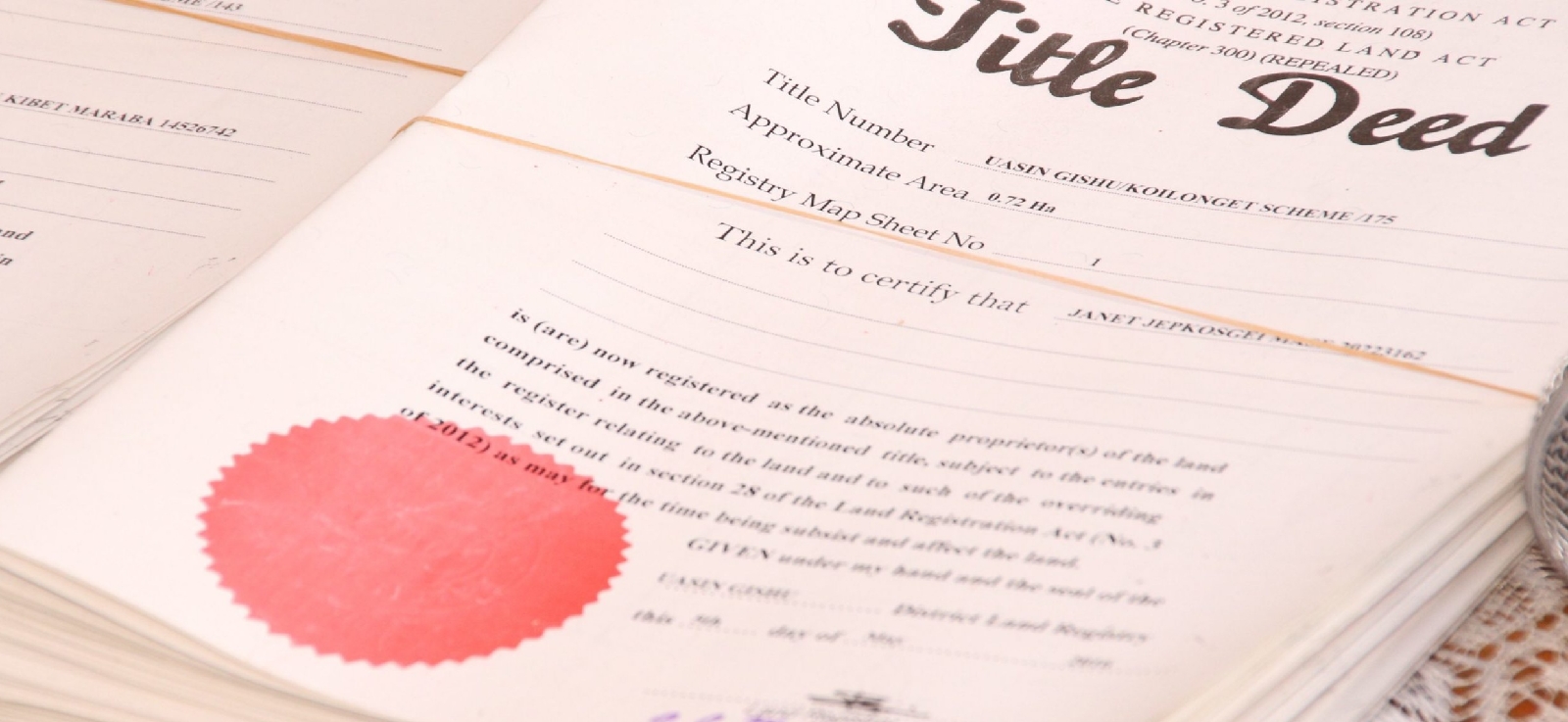

- What the seller needs to do: Provide identity docs, marital status details, and title deed (if available).

3. Provide Documents and Authorizations

You’ll need to provide:

- ID book or card.

- Marriage certificate (or ANC contract, if applicable).

- Title deed (or your bank’s bond reference if still bonded).

- Municipal account details for clearance purposes.

- Authorization for bond cancellation (if applicable).

4. Obtain and Pay for Compliance Certificates

You must supply various compliance certificates:

- Electrical Certificate of Compliance (CoC): Mandatory.

- Beetle Certificate: Required in some coastal areas, especially for freestanding homes.

- Plumbing Certificate: Required in cities like Cape Town.

- Gas Certificate: Needed if you have a gas installation.

Tip: Hire certified contractors to inspect and issue these. Costs vary.

5. Settle Rates & Taxes in Advance

- The municipality requires upfront payment of rates, water, and electricity—usually 2 to 3 months’ worth, even if you’re selling.

- The conveyancer applies for a Rates Clearance Certificate.

- Timeframe: This step alone can take 10–30 days, depending on the municipality.

6. Cancel the Existing Bond (If Any)

- Your conveyancer will notify your bank to cancel your home loan.

- Most banks require 90 days' notice to avoid early termination penalties.

- Once cancellation figures are issued, your bank will send the bond cancellation instructions to the bond cancellation attorney (appointed by the bank).

7. Wait for the Buyer’s Bond Approval

- If the OTP is subject to the buyer obtaining a home loan, this must be finalized before transfer can proceed.

- The buyer’s bank appoints their own bond attorney, who works with your conveyancer.

- This can take anywhere from 7 to 30 days depending on how quickly the buyer acts.

8. Sign Transfer Documents

- The conveyancer will call you in to sign the transfer documents, including:

- Power of Attorney to transfer the property.

- Declaration of marital status.

- Transfer duty declarations (for SARS).

- If you're overseas or unavailable, you may need to sign in front of a notary or consulate.

9. Transfer Duty & SARS Clearance

- The conveyancer submits documents to SARS to pay transfer duty (usually the buyer’s responsibility unless exempt).

- SARS must issue a Transfer Duty Receipt before the property can be registered.

- Timing: 7–14 working days on average.

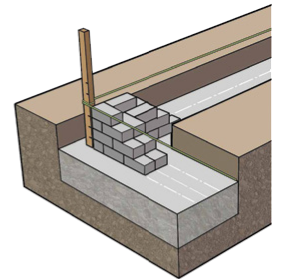

10. Lodgement in the Deeds Office

- Once all documents, certificates, and payments are in place, the conveyancer lodges the transfer with the Deeds Office.

- If there’s a bond: 3 sets of attorneys coordinate (bond attorney, bond cancellation attorney, and transferring attorney).

- Registration usually happens 7–10 working days after lodgement.

11. Registration and Final Handover

- Once registered, the new buyer officially owns the property.

- The buyer receives the keys (typically via the estate agent), and:

- The seller gets paid out (minus any outstanding bond or fees).

- The buyer takes over the municipal accounts.

12. Cancel Municipal Accounts & Utilities

- Notify your municipality, Eskom (if applicable), and service providers.

- Ensure final meter readings are done on or just before the registration day.