Lake Properties Lake Properties

Lake Properties Lake Properties

Here’s a comprehensive breakdown on how to evaluate potential tenants for your investment property in South Africa, with added context, legal notes, and practical tools you can use.

1. Initial Tenant Screening (Pre-Qualifying Stage)

Before even scheduling a viewing, save time by asking simple questions over the phone or via a form:

- Employment: Where do you work? How long have you been employed?

- Income: What is your monthly net salary?

- Reason for Moving: Are they relocating for work, upsizing, downsizing?

- Rental History: Do they have past experience renting? Any issues?

- Number of Occupants: Who will be living in the unit (names, ages)?

- Pets: If the property doesn't allow pets, confirm this upfront.

- Move-In Date: Are they available to move in when your property is ready?

Why it matters: This avoids wasting time on clearly unqualified applicants (e.g., insufficient income, unsuitable move-in date, etc.).

2. Comprehensive Rental Application

Create or download a formal rental application form. This should collect:

- Full legal name, ID/passport number

- Work details: employer name, duration of employment, job title, salary

- Bank account info (for payment setup and verification)

- Current and past addresses (at least 3 years)

- Emergency contact info

- Consent to do a credit and background check (this is a legal requirement)

Tools you can use:

- Downloadable rental forms from TPN Credit Bureau or Private Property

- Consider Google Forms or PDF applications for efficiency

3. Affordability and Employment Verification

A solid rule of thumb in SA: Net income should be at least 3x the monthly rent.

Ask for:

- 3–6 months of recent bank statements

- 3 months’ payslips

- Letter of employment confirming position, salary, and contract status

- If self-employed: CIPC registration, company bank statements, and tax returns

Red Flags:

- High debt-to-income ratio

- Unstable income or short employment duration

- Irregular large cash deposits

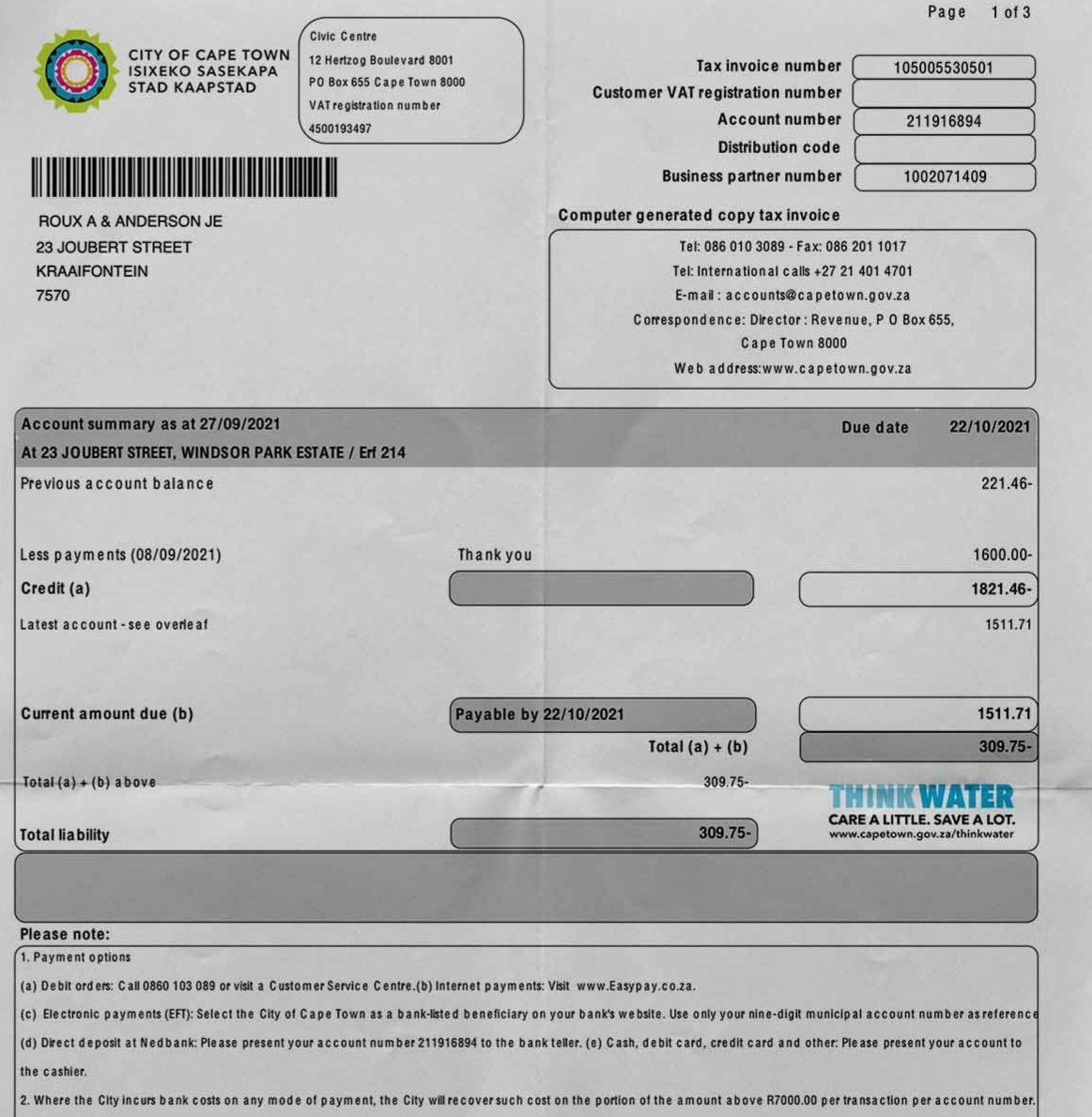

4. Credit and Background Check

Run a credit report and tenant history check through:

- TPN (Tenant Profile Network) – trusted in SA property sector

- Experian South Africa

- XDS or TransUnion SA

Look for:

- Credit score: Aim for 600+, but context matters

- Judgments or defaults: Especially from previous landlords, banks, or municipalities

- Payment patterns: Frequent missed payments or arrears are red flags

Cost: These checks typically cost R50–R150 depending on the platform.

5. Reference Checks

Speak to:

- Previous landlords: Did they pay on time? Were there complaints? Did they leave the place in good condition?

- Employer: Are they still employed and in good standing?

Warning signs:

- Tenant can’t provide references

- References are uncontactable or vague

- Prior eviction or unpaid rent

6. Lease Agreement (Legal Protection)

Use a Rental Housing Act-compliant lease:

- Clearly state rental amount, due date, annual increase terms

- Security deposit terms

- Maintenance responsibilities

- Rules for pets, smoking, or subletting

- Termination notice requirements

Where to get a proper lease:

- TPN LeasePack (updated with legal compliance)

- SA Property Investors Network

- LegalWise or an attorney (if needed for customization)

Tip: Sign it digitally using tools like DocuSign or HelloSign if convenient.

7. Deposit Handling (Rental Housing Act)

- Collect 1–2 months’ rent as a deposit (standard in SA)

- Must be placed in an interest-bearing account and interest belongs to the tenant

- Provide proof of the deposit and interest account upon request

- Return deposit within 7–14 days after move-out, minus documented deductions

8. Ingoing Inspection & Documentation

Before tenant moves in:

- Conduct a joint inspection with the tenant

- Record property condition in detail (photos + checklist)

- Both parties must sign this inspection report (required by law)

This protects you from disputes about damages when the tenant leaves.

9. Ongoing Tenant Management

- Insist on debit orders for rent payments—more secure than EFTs

- Track rent payments and arrears using tools like TPN RentBook or PayProp

- Respond professionally to repair requests (required within reasonable time)

- Keep records of all communication, repairs, and payment history

10. Optional Protection: Landlord Insurance

Consider:

- Loss of rental income coverage

- Eviction legal assistance

- Structural damage or theft protection

Companies in SA offering this:

- King Price Insurance

- Santam

- Hollard

- Etana

Final Advice

Trust your process, not your gut. Even friendly or well-spoken applicants need to be vetted properly. It’s better to leave the property vacant for a bit than to rush into a lease with a high-risk tenant.